The Tax Treatment Regarding The Sale Of Existing Assets

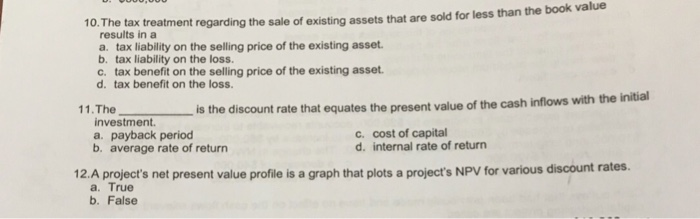

The tax treatment regarding the sale of existing assets. A loss and resulting tax benefit. T is treated as having sold all of its assets at FMV to a new corporation New T. Thus it is advantageous to make a Code 338 election for T only in certain limited circumstances ie T has a large NOL.

A capital gain tax liability The tax treatment regarding the sale of existing assets that are sold for more than the book value but less than the original purchase price results in an ________. A capital gain tax liability. An ordinary tax benefit.

An ordinary tax benefit c. B a capital gain tax liability. If you operate the newly acquired.

No tax benefit or liability. The formula for an assets tax basis is. Under current law for the seller to get a favorable tax rate on capital gain the asset must be held longer than one year.

65 The tax treatment regarding the sale of existing assets that are sold for their book value results in _____. Gain on capital assets held for shorter periods is still considered capital gain and may sometimes be advantageous but the advantages do not include any break on the tax rate. And If the existing assets are sold for the amount that is less than book value it is considered as the recaptured.

If the existing assets are sold for the amount that is more than book value it is considered as the capital gain tax liability. The tax treatment regarding the sale of existing assets that are sold for their. A capital gain tax liability and recaptured depreciation taxed as ordinary income.

The tax treatment regarding the sale of existing assets that are sold for more than the original purchase price results in _____. No tax benefit or liability d.

No tax benefit or liability 66 The portion of an assets sale price that is above its book value and below its initial purchase price is called ________.

There is no tax benefit or liability if the sale of existing assets are made on their book value. Thus it is advantageous to make a Code 338 election for T only in certain limited circumstances ie T has a large NOL. Gain on capital assets held for shorter periods is still considered capital gain and may sometimes be advantageous but the advantages do not include any break on the tax rate. This is because the gain from the asset sale is taxed twice- the corporation must pay taxes on the gain from the sale of the business and the shareholders pay taxes again when the net proceeds are distributed to them. A capital gain tax liability. A loss and resulting tax benefit. T is treated as having sold all of its assets at FMV to a new corporation New T. B a capital gain tax liability. The tax treatment regarding the sale of existing assets that are sold for their book value results in _____.

65 The tax treatment regarding the sale of existing assets that are sold for their book value results in _____. Old T recognizes and is taxed on the full gain and loss on the deemed sale of its assets. The tax treatment regarding the sale of existing assets that are sold for more than the book value but less than the original purchase price results in an _____. Thus it is advantageous to make a Code 338 election for T only in certain limited circumstances ie T has a large NOL. The formula for an assets tax basis is. The tax treatment regarding the sale of existing assets that are sold for their. Under current law for the seller to get a favorable tax rate on capital gain the asset must be held longer than one year.

.jpg)

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-02-0538cfc8437b4b2ba4724c9443c6d393.jpg)

Post a Comment for "The Tax Treatment Regarding The Sale Of Existing Assets"